If you’re wondering how much Section 8 pays for a 3-bedroom unit, the answer is it varies significantly based on location and the specific rent limits set by the U.S. Department of Housing and Urban Development (HUD). Generally, Section 8, officially known as the Housing Choice Voucher Program, assists low-income families, the elderly, and the disabled in affording safe and decent housing in the private market. The program pays a portion of the rent, with the tenant typically responsible for paying 30% of their adjusted income towards rent and utilities. The remaining amount is paid directly to the landlord by the Public Housing Agency (PHA).

The amount Section 8 pays for a 3-bedroom home is determined by a combination of factors, primarily the Fair Market Rent (FMR) for the specific metropolitan area or county, and the PHA’s Payment Standards. These limits are designed to ensure that voucher holders can find housing in their desired neighborhoods while also protecting landlords from unfair rental rates. Let’s delve deeper into how these figures are established and what influences the Section 8 voucher amounts for a 3-bedroom dwelling.

Image Source: ik.imagekit.io

Deciphering Fair Market Rent (FMR) for a 3-Bedroom Section 8

Fair Market Rent (FMR) is a crucial component in determining the Section 8 subsidy 3 bedroom payment. HUD sets FMRs annually for different geographic areas, and they are based on the cost of renting a modestly modest housing unit in a specific locality. The FMR for a 3-bedroom unit represents the 40th percentile of gross rents (rent plus utilities) for that size unit. This means that 40% of the rental units of that size in the area are expected to be available at or below the FMR.

How is Fair Market Rent Calculated?

HUD uses extensive data from the American Community Survey (ACS) and other sources to calculate FMRs. They look at factors like:

- Geographic Location: Rents vary dramatically from one city to another, and even within different neighborhoods of the same city.

- Number of Bedrooms: The FMR is specific to the number of bedrooms in the unit. A 3-bedroom unit will have a different FMR than a 2-bedroom or 4-bedroom unit.

- Rental Market Conditions: Inflation, local economic growth, and housing demand all influence rental prices.

The FMR for a 3-bedroom unit serves as a cap on the Housing Choice Voucher 3 bedroom payment. While the tenant pays 30% of their income, the total rent charged by the landlord cannot exceed the FMR. However, this is not the final figure.

Examining Section 8 Payment Standards for 3-Bedroom Units

While FMR sets an upper limit, the actual amount Section 8 pays for a 3-bedroom unit is often more closely aligned with the PHA’s Payment Standards. These standards are established by each PHA and are generally set at 90% to 120% of the FMR for the area.

How Section 8 Rent is Calculated

The calculation process involves several steps:

- Determine the Contract Rent: This is the total amount the landlord charges for the unit, including utilities if the landlord pays for them.

- Determine the Tenant’s Rent Portion: The tenant is responsible for paying 30% of their adjusted monthly income. Adjusted income is the gross income minus certain deductions allowed by HUD (e.g., for dependent children, elderly family members, or disability expenses).

- Calculate the PHA’s Portion (Subsidy): The PHA pays the difference between the Contract Rent and the Tenant’s Rent Portion. However, the Contract Rent cannot exceed the PHA’s Payment Standard for a 3-bedroom unit, or the FMR if that is lower.

Formula:

- Tenant’s Rent = 30% of Adjusted Monthly Income

- PHA’s Payment = Contract Rent – Tenant’s Rent

- BUT: Contract Rent ≤ Payment Standard (or FMR, whichever is lower)

This means if a landlord charges $1,500 for a 3-bedroom unit, and the PHA’s Payment Standard for a 3-bedroom is $1,400, the PHA will not approve the lease at $1,500. The maximum rent the PHA will subsidize is $1,400. If the tenant’s portion of the rent is $400, the PHA would pay $1,000.

Key Factors Influencing Section 8 Voucher Amounts for a 3 Bedroom

Several dynamic elements contribute to the final HUD rental assistance 3 bedroom payment:

- Location, Location, Location: This is arguably the most significant factor. Rental markets in major metropolitan areas like New York City or San Francisco will have vastly higher FMRs and Payment Standards than those in rural areas. This directly impacts the Section 8 rent limits by bedroom.

- PHA Policies: Each PHA has the discretion to set its payment standards within the allowed range (90-120% of FMR). Some PHAs may choose to set their standards higher to encourage landlords to participate in the program and offer a wider choice of housing for voucher holders.

- Utilities: Whether utilities are included in the rent or paid separately by the tenant significantly affects the total housing cost. FMRs typically include utilities. If a landlord includes utilities, the FMR will be a more direct comparison. If utilities are separate, the PHA will assess the average utility costs for the area and may adjust the subsidy accordingly.

- Voucher Holder’s Income: The tenant’s income directly determines their contribution to the rent. A voucher holder with a lower income will have a smaller rent portion, leading to a larger subsidy from the PHA for the same unit. Conversely, someone with a higher income within the program will pay more towards the rent.

- Market Demand and Supply: In areas with high housing demand and low supply, rents tend to be higher, and consequently, Section 8 limits will also be higher.

Understanding HUD Income Limits for Section 8

It’s important to distinguish between rent limits and income limits. HUD income limits for Section 8 determine who is eligible for the program in the first place. These limits are set by HUD based on the median income for the area and vary by household size. Generally, a family must have an income below 80% of the median income for the area to qualify for a voucher. However, many PHAs prioritize families with incomes below 30% of the median income.

The actual rent a voucher holder pays is tied to their income, not directly to the income limits for eligibility.

Average Section 8 Rent for a 3 Bedroom: What to Expect

Pinpointing an exact average Section 8 rent for a 3 bedroom across the entire country is difficult because of the vast differences in local housing markets. However, we can provide a framework for how to find this information for a specific area.

To get a general idea of what Section 8 pays for a 3-bedroom in a particular location, you would typically:

- Identify the Local PHA: Every metropolitan area and many counties have at least one PHA.

- Visit the PHA’s Website: Most PHAs publish their current payment standards online. This is the most reliable source for local Section 8 payment standards 3 bedroom.

- Consult HUD’s FMR Data: HUD provides FMRs for all areas on its website. You can use this to understand the baseline rent levels.

Example Scenario:

Let’s consider a hypothetical city where:

- HUD’s FMR for a 3-bedroom unit: $1,400

- PHA’s Payment Standard for a 3-bedroom unit: $1,500 (set at approximately 107% of FMR)

Now, consider a family with a 3-bedroom voucher:

- Family’s Adjusted Monthly Income: $1,200

Calculation:

- Tenant’s Rent Portion: 30% of $1,200 = $360

- Maximum Approved Rent: The PHA’s Payment Standard is $1,500.

- Landlord’s Agreed Rent: Let’s say the landlord charges $1,450 for the 3-bedroom unit.

- PHA’s Subsidy: $1,450 (Landlord’s Rent) – $360 (Tenant’s Portion) = $1,090

In this scenario, the PHA would pay $1,090 per month towards the rent, and the tenant would pay $360, for a total rent of $1,450. If the landlord had charged $1,600, the lease would not be approved because it exceeds the PHA’s Payment Standard of $1,500.

Section 8 Rent Limits by Bedroom: A Closer Look

The Section 8 rent limits by bedroom are critical for both tenants and landlords. These limits ensure that the program remains financially sustainable and that voucher holders are not priced out of the market due to exorbitant rents.

The Relationship Between FMR, Payment Standards, and Tenant Contribution

It’s a tiered system:

- FMR (Fair Market Rent): This is HUD’s estimate of what a modest rental unit in a specific area would cost. It’s a benchmark.

- Payment Standard: This is what the PHA sets, typically a percentage of the FMR. It’s the maximum amount the PHA is willing to pay for rent for a specific bedroom size.

- Tenant Contribution: This is always 30% of the tenant’s adjusted income, capped so that the total rent (tenant’s portion + PHA’s portion) doesn’t exceed 150% of the FMR (though this is an exception and not the norm). The primary cap is the payment standard.

What If the Actual Rent is Lower Than the Payment Standard?

If the agreed-upon rent is lower than the payment standard, the PHA will pay the difference between the actual rent and the tenant’s contribution. For example, if the payment standard is $1,500, but the landlord agrees to rent a 3-bedroom unit for $1,300, and the tenant’s portion is $400, the PHA will pay $900 ($1,300 – $400). This is a common scenario and can be advantageous for tenants as it means their rent portion might be lower than the maximum allowed.

What If the Actual Rent is Higher Than the Payment Standard?

As mentioned, if the landlord’s desired rent exceeds the PHA’s payment standard for a 3-bedroom unit, the lease will typically not be approved unless the PHA allows for higher payment standards in specific circumstances and the tenant’s income can cover the difference. However, for standard voucher use, the payment standard is the hard limit.

Finding Local Section 8 Payment Standards

To find the most accurate Section 8 payment standards 3 bedroom for your area, you should always refer to your local PHA. You can usually find them by:

- Searching Online: Type “[Your City/County] Housing Authority” into a search engine.

- Contacting the PHA Directly: Call their office and ask for information on their current rent limits or payment standards for a 3-bedroom unit.

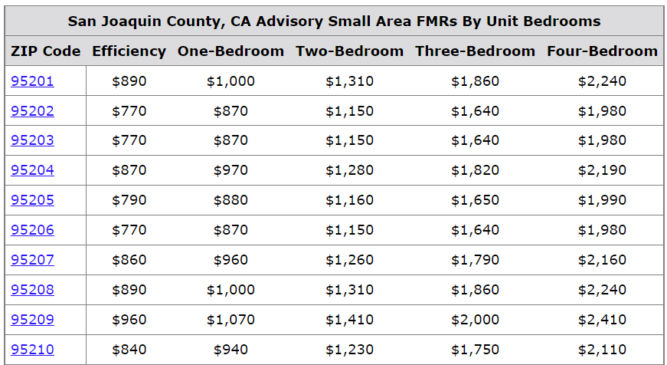

Sample Data Representation (Illustrative – Actual figures vary by location)

| Location | HUD FMR (3-Bedroom) | PHA Payment Standard (3-Bedroom) |

|---|---|---|

| Small City, USA | $1,000 | $1,100 |

| Mid-Size City, USA | $1,300 | $1,450 |

| Major Metro, USA | $2,000 | $2,200 |

Note: These are purely illustrative and do not reflect actual current rates. Always check with your local PHA for precise figures.

The Role of Rent Reasonableness

In addition to FMR and payment standards, PHAs must also ensure that the rent charged by the landlord is “reasonable” compared to other similar unassisted units in the same market. This is a crucial step in the approval process.

How Rent Reasonableness is Assessed

The PHA will typically perform a “rent reasonableness study” before approving a lease. This study may involve:

- Comparing to Similar Units: The PHA will look at the rent charged for comparable 3-bedroom units in the immediate vicinity, considering factors like size, age, amenities, and condition.

- Analyzing Market Data: They may use rental listings and other market data to determine if the proposed rent is in line with the general rental market.

If the landlord’s proposed rent is deemed unreasonable, the PHA will require them to lower it to a reasonable level before the lease can be approved. This protects both the program and the voucher holder from being overcharged.

Challenges and Considerations for Voucher Holders

While Section 8 provides vital assistance, navigating the program can present challenges:

- Finding Landlords Willing to Accept Vouchers: Not all landlords participate in the Section 8 program. Some may have misconceptions about the program or concerns about potential issues.

- Limited Housing Choice: In areas with high rents and low payment standards, voucher holders may find their choices limited to less desirable neighborhoods or smaller units than they require.

- Waiting Lists: There can be long waiting lists for Section 8 vouchers, especially in high-demand areas.

- Utility Costs: If utility costs are high and not included in the rent, a voucher holder’s 30% contribution can become a significant portion of their income, even with the subsidy.

Maximizing Your Section 8 Voucher for a 3 Bedroom

For families needing a 3-bedroom unit, maximizing the benefit of their voucher involves strategic searching and negotiation:

- Research Your Local PHA’s Payment Standards: Knowing the limits for a 3-bedroom unit in your area is your first step.

- Look for Units Where Rent is Below the Payment Standard: This leaves room for your own rent contribution and potentially allows for a better-quality unit within your budget.

- Consider Including Utilities: Units where the landlord pays for utilities can sometimes simplify budgeting, as your 30% contribution is more predictable.

- Be Prepared to Negotiate: While landlords set their rent, understanding the market and the PHA limits can give you leverage in negotiations.

- Explore Different Neighborhoods: Expanding your search area can reveal more affordable options that still fit within the Section 8 guidelines.

Frequently Asked Questions (FAQ)

Q1: How much does Section 8 pay for rent on average for a 3-bedroom?

A: There isn’t a single national average because Section 8 voucher amounts are highly dependent on local Fair Market Rents (FMRs) and PHA Payment Standards. A 3-bedroom unit could range from subsidized rents of $800-$1,000 in low-cost areas to $2,000-$3,000 or more in expensive metropolitan areas. You must check your local PHA’s published limits for precise figures.

Q2: What is the maximum rent Section 8 will pay for a 3-bedroom?

A: The maximum rent Section 8 will pay for a 3-bedroom is determined by the Public Housing Agency’s (PHA) Payment Standard for that bedroom size in your specific location. This is usually set at 90-120% of the HUD Fair Market Rent (FMR). The actual amount paid is also influenced by the tenant’s income, as they contribute 30% of their adjusted income.

Q3: Can Section 8 pay for rent that is higher than the Fair Market Rent (FMR)?

A: Generally, the PHA’s payment standard, which is often based on the FMR, serves as the maximum subsidy. However, HUD does allow PHAs to set payment standards up to 120% of the FMR in high-rent areas. The tenant’s portion of the rent, combined with the PHA’s subsidy, cannot exceed the landlord’s actual rent, and the total rent is capped by the payment standard.

Q4: How do I find out the Section 8 rent limits for my area for a 3-bedroom?

A: The best way to find out the specific Section 8 rent limits by bedroom is to contact your local Public Housing Agency (PHA). Their website usually has a section detailing payment standards, or you can call their main office. You can also find HUD’s FMR data on the HUD website, which serves as a baseline.

Q5: Does Section 8 pay for utilities for a 3-bedroom unit?

A: The Housing Choice Voucher Program (Section 8) provides a subsidy that can be used for rent. The FMR and payment standards generally include utilities. If utilities are paid separately by the tenant, the PHA will consider the average utility costs for the area when determining the subsidy. However, the tenant is ultimately responsible for their portion of rent and any utilities not covered by the subsidy.

Q6: What are HUD income limits for Section 8 for a family of 3 or 4 people needing a 3-bedroom?

A: HUD income limits for Section 8 are set based on the median income for the area and the number of people in the household. For a 3-bedroom unit, families typically need a 3-bedroom voucher, which is usually intended for families of 3-4 people. These income limits determine eligibility for the program itself, not the rent amount paid. To get specific income limit figures for your area, you should check with your local PHA or the HUD website.

Q7: If my income is low, will Section 8 pay almost all the rent for a 3-bedroom?

A: If your adjusted income is very low, your 30% contribution to the rent will also be very low. In such cases, the Section 8 subsidy paid by the PHA will cover the majority of the rent, up to the PHA’s payment standard for a 3-bedroom unit. The PHA’s goal is to ensure that your rent burden doesn’t exceed 30% of your adjusted income.

Q8: What is a Housing Choice Voucher 3 bedroom payment?

A: A Housing Choice Voucher 3 bedroom payment refers to the amount of rental assistance the PHA provides for a family renting a 3-bedroom unit. This payment is the difference between the agreed-upon rent (which cannot exceed the PHA’s payment standard) and the tenant’s contribution, which is 30% of their adjusted monthly income.

Q9: How is Section 8 rent calculated for a 3-bedroom unit with utilities included?

A: When utilities are included in the rent for a 3-bedroom unit, the PHA will assess the total rent charged by the landlord. The tenant will pay 30% of their adjusted income. The PHA will pay the remaining amount, up to the PHA’s Payment Standard for a 3-bedroom unit. The FMR for a 3-bedroom unit also typically includes utilities, making it a direct comparison for the total rent.

By thoroughly researching local payment standards and understanding these fundamental components, individuals and families can better navigate the Section 8 program to find suitable 3-bedroom housing.