The amount the Section 8 program, officially known as the housing choice voucher program, pays for a 2-bedroom rental varies significantly by location. Generally, it covers the difference between a tenant’s share of the rent and the Fair Market Rent (FMR) set by the U.S. Department of Housing and Urban Development (HUD) for that specific area.

The housing assistance payments made through Section 8 aim to make affordable housing vouchers accessible to low-income families, the elderly, and people with disabilities. Understanding these rent subsidies is crucial for both renters seeking housing and landlords looking to participate in the program. This in-depth guide will delve into how Section 8 determines payments for 2-bedroom units, what factors influence these amounts, and how you can find out the specific limits in your area. We’ll explore the intricacies of HUD rent limits, voucher amounts, HUD section 8 payment standards, and how they relate to subsidized housing rent, low-income housing rent, and public housing rent.

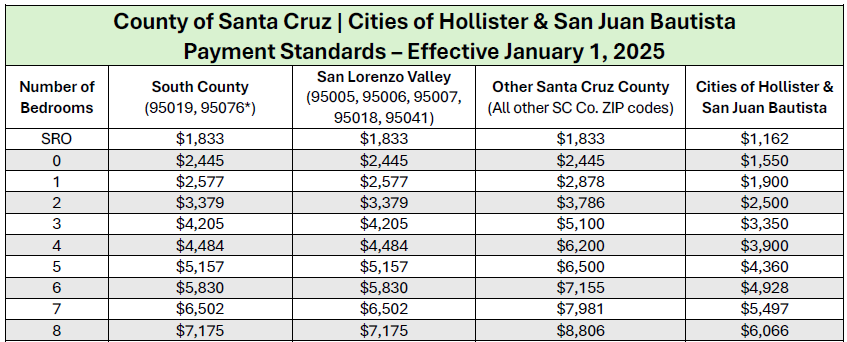

Image Source: hacosantacruz.org

Deciphering HUD Rent Limits for 2-Bedroom Units

At the core of Section 8 payments are HUD rent limits. These limits are not arbitrary figures; they are carefully calculated based on extensive market research. HUD establishes Fair Market Rents (FMRs) for different types of housing units, including 2-bedroom apartments, in specific geographic areas. The goal is to ensure that families can find safe, decent, and sanitary housing in a variety of neighborhoods.

What are Fair Market Rents (FMRs)?

FMRs represent the 40th percentile of what a renter would expect to pay for a decent, modest rental unit in a specific local market. This means that 40% of the available rental units in that area would likely cost less than the FMR, and 60% would cost more. HUD uses FMRs to determine the maximum amount that a Public Housing Agency (PHA) can pay for a family’s housing unit under the Housing Choice Voucher Program.

How FMRs are Calculated

HUD’s methodology for calculating FMRs involves several steps:

- Data Collection: HUD gathers data from various sources, including the American Community Survey (ACS), Census Bureau data, and other reliable market surveys.

- Geographic Specificity: FMRs are typically set at a metropolitan statistical area (MSA) level or for specific counties within a state. This allows for variations based on local housing market conditions.

- Unit Size Adjustment: FMRs are set for different bedroom sizes. A 2-bedroom unit will have a different FMR than a 1-bedroom or 3-bedroom unit.

The Role of Payment Standards

While FMRs set the overall market benchmark, HUD section 8 payment standards are the actual amounts that a PHA is authorized to pay for rental assistance. Payment standards are established by each PHA and are typically set at a level that reflects 90% to 110% of the FMR for each bedroom size. This flexibility allows PHAs to better adapt to local market conditions and ensure a sufficient supply of affordable housing.

For a 2-bedroom unit, the PHA will determine a payment standard. This payment standard is the maximum monthly rent that the PHA will subsidize for a qualifying family. The rent charged by the landlord must be reasonable and comparable to similar unassisted units in the same market.

Determining Your Voucher Amount for a 2-Bedroom

The voucher amounts a family receives through Section 8 are not fixed. They are calculated based on a family’s income and the FMR for their chosen unit. The fundamental principle of the housing choice voucher program is that a participating family should not pay more than 30% of their adjusted gross monthly income for rent and utilities.

Calculating Tenant Rent

The tenant’s portion of the rent is determined as follows:

- Adjusted Gross Monthly Income: This is calculated by taking a family’s total income and subtracting certain deductions, such as allowances for dependents, elderly family members, and certain childcare expenses.

- 30% Rule: The family will pay 30% of their adjusted gross monthly income towards rent and utilities.

- Housing Assistance Payment: The PHA then pays the difference between the total rent and utilities and the tenant’s portion.

Formula:

- Tenant’s Rent Contribution = 30% of Adjusted Gross Monthly Income

- Housing Assistance Payment (Voucher Amount) = Total Rent & Utilities – Tenant’s Rent Contribution

Example Scenario

Let’s say the FMR for a 2-bedroom unit in a particular area is $1,200. A PHA has set its payment standard at $1,150 for a 2-bedroom unit.

A family participating in the program has an adjusted gross monthly income of $1,500.

- Tenant’s Rent Contribution: $1,500 * 0.30 = $450

If the total rent for a 2-bedroom apartment is $1,100, and utilities are $100, the total housing cost is $1,200.

- Housing Assistance Payment: $1,200 (Total Rent & Utilities) – $450 (Tenant’s Contribution) = $750

In this scenario, the PHA would pay $750 directly to the landlord, and the family would pay $450. The total rent paid would be $1,200, which is within the FMR and below the PHA’s payment standard.

Factors Influencing Section 8 Payments for 2-Bedroom Rentals

Several factors contribute to the variation in Section 8 payments for 2-bedroom units across different locations. It’s essential to be aware of these influences to accurately gauge potential assistance.

Geographic Location and Cost of Living

The most significant factor influencing HUD rent limits and, consequently, Section 8 payments is geographic location. Areas with a higher cost of living and more expensive housing markets will naturally have higher FMRs and payment standards for 2-bedroom units. For instance, a 2-bedroom apartment in a major metropolitan area like New York City or San Francisco will have substantially higher Section 8 payment limits than a similar unit in a rural town.

Property Size and Amenities

While Section 8 primarily focuses on the number of bedrooms, the specific size of the unit and the amenities it offers can also play a role in how landlords price their rentals. However, the PHA’s payment standard is primarily tied to the bedroom count and the established FMR. A larger 2-bedroom unit or one with more upscale amenities might command a higher rent, but the voucher amount is capped by the payment standard for that bedroom size.

Local Market Conditions

PHAs regularly review and update their payment standards to reflect current local housing market conditions. Factors such as vacancy rates, rental demand, and the availability of comparable unassisted housing units are considered. In areas with low vacancy rates and high demand for rental properties, PHAs may adjust their payment standards upwards to ensure that voucher holders have a reasonable choice of housing options.

Utility Costs

In some cases, utility costs are included in the tenant’s rent contribution calculation. However, often utilities are paid separately. The total rent that the PHA will subsidize typically includes the base rent plus certain utilities that are the landlord’s responsibility. The FMR is intended to cover the cost of a modest rental unit, including utilities that are typically included in the rent.

Finding Section 8 Rent Limits for a 2-Bedroom in Your Area

To determine how much Section 8 might pay for a 2-bedroom rental in a specific location, you need to consult official HUD resources and your local PHA.

Accessing HUD Fair Market Rents

HUD publishes FMRs annually for all geographic areas across the United States. You can find this information on the HUD website. The process typically involves navigating to the FMR section and selecting your state and then your specific metropolitan area or county.

Steps to Find FMRs:

- Visit the HUD Website: Go to the official HUD website.

- Locate FMR Information: Search for “Fair Market Rents” or “FMRs.”

- Select Your Area: You will usually find a tool or a downloadable list where you can input your state and county or metropolitan statistical area (MSA).

- Identify 2-Bedroom FMR: Once you’ve selected your area, look for the FMR specifically for a 2-bedroom unit.

Contacting Your Local PHA

Your local Public Housing Agency (PHA) is the most direct source for information on HUD section 8 payment standards and how they apply to your specific situation. PHAs administer the Housing Choice Voucher Program at the local level and are responsible for setting their payment standards.

What to Ask Your PHA:

- What is the current payment standard for a 2-bedroom unit in your service area?

- What is the average rent for a 2-bedroom apartment in your area?

- Are there any specific requirements for landlords participating in the program?

- Where can I find a list of available subsidized housing units?

The PHA can provide you with the most up-to-date and accurate figures relevant to your local housing market. They can also guide you through the application process and explain the various aspects of the housing choice voucher program.

How Landlords Participate in the Program

Landlords play a vital role in the success of the Section 8 program. By renting to voucher holders, they help provide much-needed affordable housing and receive reliable rental income. Understanding the landlord’s perspective can also be beneficial for renters.

Landlord Responsibilities and Benefits

When a landlord agrees to rent a 2-bedroom unit to a Section 8 participant, they enter into a contract with the PHA.

Benefits for Landlords:

- Guaranteed Rental Income: The PHA pays a portion of the rent directly to the landlord each month, providing a stable and predictable income stream.

- Access to a Wider Tenant Pool: Participating in Section 8 can expand a landlord’s potential tenant base.

- Property Inspections: While an initial inspection is required, ongoing inspections help ensure the property is maintained to safe living standards, potentially aiding in early detection of issues.

Landlord Responsibilities:

- Rent Reasonableness: The rent charged must be comparable to unassisted units in the same area. PHAs will conduct a rent reasonableness study.

- Property Maintenance: The landlord must maintain the property in good condition, adhering to housing quality standards.

- Lease Agreement: The landlord must sign a lease with the tenant and a Housing Assistance Payments (HAP) contract with the PHA.

The Initial Rent Reasonableness Study

Before a tenant can move into a unit, the PHA will conduct a rent reasonableness study. This involves comparing the proposed rent for the Section 8 unit to the rents charged for similar, unassisted units in the same neighborhood. If the proposed rent is deemed too high compared to the market, the PHA will not approve it, and the landlord may need to lower the rent. This is a critical step in ensuring that subsidized housing rent remains fair and competitive.

Section 8 and Low-Income Housing Rent

The Section 8 program is a cornerstone of low-income housing rent solutions in the United States. By bridging the gap between what low-income families can afford and the market-rate rent, it makes a significant difference in housing stability.

Bridging the Affordability Gap

For families struggling to find affordable housing vouchers, Section 8 is often the most viable option. The program effectively lowers the housing cost burden, allowing families to allocate more of their income to other essential needs like food, healthcare, and education. This, in turn, contributes to improved well-being and economic opportunity for low-income households.

Comparing Section 8 to Public Housing Rent

While both Section 8 and public housing rent are designed to assist low-income individuals, they operate differently.

- Public Housing: This involves government-owned and operated housing units where rents are typically calculated as a percentage of the tenant’s income. The units are directly managed by PHAs.

- Section 8 (Housing Choice Voucher Program): This program provides vouchers that tenants can use in privately owned rental properties. The PHA pays a portion of the rent directly to the landlord.

The amount of public housing rent is generally fixed based on the tenant’s income. Section 8 payments, on the other hand, depend on the contract rent of the chosen unit, the FMR for that unit size and location, and the tenant’s income.

Frequently Asked Questions About Section 8 for 2-Bedroom Rentals

Q1: How much exactly does Section 8 pay for a 2-bedroom rental?

A1: The exact amount Section 8 pays for a 2-bedroom rental is determined by the HUD Fair Market Rent (FMR) for the specific geographic area, the PHA’s payment standard (which is usually a percentage of the FMR), and the tenant’s income. The voucher amount is the difference between the total rent and utilities and 30% of the tenant’s adjusted gross monthly income.

Q2: Can I find out the specific HUD rent limits for my area?

A2: Yes, you can find the specific HUD Fair Market Rents (FMRs) for your area on the official HUD website. You should also contact your local Public Housing Agency (PHA) for their specific payment standards for 2-bedroom units, as these can vary slightly.

Q3: What if the rent for a 2-bedroom is higher than the Section 8 payment standard?

A3: If the rent for a 2-bedroom unit is higher than the PHA’s payment standard, the tenant would be responsible for paying the difference above the payment standard, in addition to their 30% share of their income. However, the PHA must approve the rent, and it must also be considered “reasonable” compared to similar unassisted units. Generally, tenants are encouraged to find units within the payment standard to minimize their out-of-pocket expenses.

Q4: Who is eligible for Section 8 housing assistance payments?

A4: Eligibility for Section 8 is primarily based on income. Families whose income is below 50% of the median income for their area are generally eligible. However, preference is often given to families with incomes below 30% of the median income. Other factors such as family size, age, disability, and veteran status can also influence eligibility and waiting list priority.

Q5: How long do I have to find a 2-bedroom rental once I receive a voucher?

A5: The typical timeframe to find a suitable rental unit after receiving a Section 8 voucher is usually 60 days, although this can vary by PHA. Some PHAs may offer extensions if there are extenuating circumstances. It’s important to communicate with your PHA about your search progress.

Q6: What are the landlord’s responsibilities when renting a 2-bedroom to a Section 8 tenant?

A6: Landlords must maintain the property to meet HUD’s housing quality standards, enter into a lease agreement with the tenant, and sign a Housing Assistance Payments (HAP) contract with the PHA. They are responsible for collecting the tenant’s portion of the rent and must allow the PHA to conduct periodic inspections of the unit.

Q7: Does Section 8 cover all utilities for a 2-bedroom rental?

A7: Section 8’s housing assistance payments are generally based on the contract rent, which may or may not include all utilities. The FMR is meant to cover a modest unit, including utilities typically included in rent. If utilities are separate, the tenant’s portion of the rent (30% of their income) will cover their share of those utilities, and the PHA will cover the rest of the rent. The specific arrangement for utilities should be clarified with the PHA and the landlord.

Q8: What is the difference between FMR and a PHA’s payment standard for a 2-bedroom unit?

A8: The FMR is a national standard set by HUD that represents the 40th percentile of gross rent for a specific unit size in a local market. The PHA’s payment standard is set by the local PHA and is typically between 90% and 110% of the FMR. This allows PHAs to better align their assistance with local market conditions. The payment standard is the maximum monthly assistance the PHA can pay for a specific unit size.

This comprehensive look at how much Section 8 pays for a 2-bedroom rental should provide a clear picture of the program’s mechanisms and the factors that influence voucher amounts. By consulting official resources and local PHAs, individuals can gain a more precise understanding of the subsidized housing rent landscape and navigate their housing options effectively.